-

What is an overlap?

An overlap is when the boundary of one Tax Incremental District (TID) covers another existing TID's boundaries. For more information, review state law (sec.

66.1105(10), Wis. Stats.).

-

Does an overlap change the boundary of the overlapped TID?

No. The overlapped TID's boundaries are not affected by an overlap. The overlapped TID must still maintain whole parcels.

-

How are TID values affected by overlapping?

The newest overlapping TID includes the current value in its TID base and will receive future increment value.

The older overlapped TID includes the increment value it received before the overlap, but no longer receives any future increment. The current value of the existing TID before the new overlapping TID was created becomes a frozen overlap value. The Wisconsin Department of Revenue (DOR) establishes the frozen overlap value and includes it in the older TID's total current year value until the TID terminates.

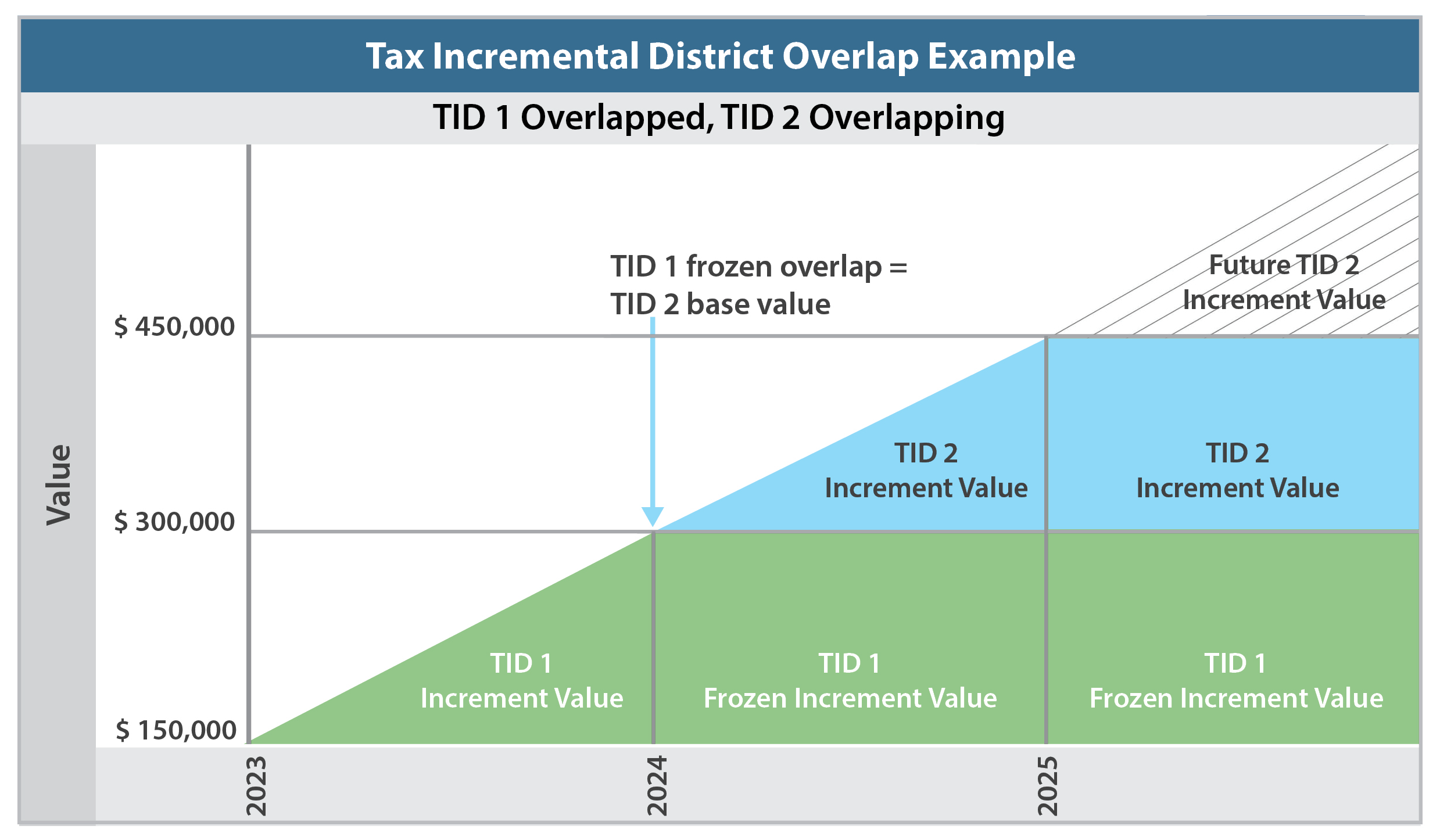

Here is a simplified example:

- TID 1 was created in 2023 with a base value of $150,000

- In 2024, the value for TID 1 is $300,000

- TID 2 is created in 2024 and completely overlaps TID 1 in 2024

- TID 2's base value is $300,000

- The frozen overlap value for TID 1 is $300,000 (the value in the year it was overlapped)

- This value remains the same for the remainder of TID 1's life

- Any property value increase in 2025 or later generates increment value for TID 2

-

How is the overlapped TID's current value calculated?

The current value of overlapped property, at the time it is overlapped, is the frozen overlap value. DOR establishes the frozen overlap value for the overlapped TID.

Example:

- TID 3 is partially overlapped by TID 4

- TID 3's base value does not change

- In the year of the overlap, the current full value of the overlapped property is $10,000

- After DOR certifies TID 4, DOR includes the $10,000 frozen overlap value in TID 3's current value

- DOR adds the $10,000 frozen value to TID 3's current value every year until the TID terminates

- The frozen overlap value will not change

- Exception: Additional property in TID 3 is overlapped

- The current values plus the frozen overlap value equals the total value used to calculate the TID increment (see table below)

- In the below example, the total current year TID 3 value is $275,000 (property value $265,000 plus $10,000 frozen overlap value)

- Current value ($275,000) minus base value ($150,000) equals a TID increment value of $125,000

| TID 3 - Value types | TID 3 - Values |

|---|

| Non-manufacturing Real Estate (RE) – not overlapped | $210,000 |

| Manufacturing RE – not overlapped | $55,000 |

| Frozen Overlap Value (for overlapped property) | $10,000 |

| Totals | |

| Total Current Year TID Value | $275,000 |

| 2015 TID Base Value | $150,000 |

| TID Increment Value | $125,000 |

-

Where can the municipality view the TID's frozen overlap value?

The municipality can view the value of the frozen overlap on the

TID Statement of Changes report.

-

Can the municipality continue paying for projects in the overlapped parcels with increment from the existing TID?

Yes. The municipality continues to receive tax increment funds for the overlapped TID to pay its project costs.

-

Does the Wisconsin Department of Revenue (DOR) use the parcel overlap value in determining the 12% value limit?

No. Under state law (sec.

66.1105(10)(c), Wis. Stats.), DOR excludes this value from the new TID when determining compliance with the 12% limit. The parcel value is already included in the value increment for the existing TID.

-

For the parcels in the overlapped area, are both the new and old TID number shown on the assessment/tax roll?

No. On the assessment/tax roll, the overlapped (older) TID number is removed from the parcel and the overlapping (newer) TID number is added to the parcel. A parcel may only have one TID number on the assessment/tax roll.

-

If the overlapping (newer) TID terminates and the overlapped (older) TID is still active, should the TID number be changed back to the overlapped TID?

No, do not put the older TID back on the overlapped parcels. The overlapped TID receives a frozen overlap value until it terminates. Putting the older TID number on the overlapped parcels may cause an incorrect current value for the overlapped TID.

-

Will the frozen overlap value of an overlapped TID be deleted if the overlapping TID is terminated?

No. Once a frozen overlap value exists for an overlapped TID, the frozen overlap value is included in the current year TID value until the overlapped TID terminates. The frozen overlap value for the overlapped TID does not change even if the overlapping TID terminates.

-

To subtract overlapped parcels, which TID does a municipality amend? The older TID or the newer TID?

To subtract overlapped parcels, the municipality must subtract the parcels from the TID currently shown on the assessment/tax roll. Generally, the newer TID is on the assessment/tax roll.

-

Is the overlapping TID always the newer TID?

Generally, a newer TID overlaps an older TID. However, a municipality may add territory to an older TID that overlaps a newer TID.

-

Will the frozen overlap value of an overlapped TID be reduced if overlapped parcels are subtracted from the overlapping TID?

No. Once a frozen overlap value exists for an overlapped TID, the frozen overlap value is included in the current year TID value until the overlapped TID terminates. The frozen overlap value does not change even if the overlapped parcels are subtracted from the overlapping TID.

-

If a new TID completely overlaps an existing TID, does the overlapped TID still exist?

Yes. The overlapped TID remains active until the municipality adopts a termination resolution. Due to the frozen overlap value, the municipality may continue to receive tax increment.

-

Can a distressed or severely distressed TID be overlapped by a newly created TID?

No. A newly created TID or an active TID that is adding parcels may not overlap a distressed or severely distressed TID.

-

Can an Environmental Remediation (ER) TID created under sec. 66.1105, Wis. Stats., overlap another TID created under the same section? Or another ER TID created under sec. 66.1106, Wis. Stats.?

Yes. An ER TID created under sec. 66.1105, Wis. Stats., can overlap another TID created under the same section or an ER TID created under sec. 66.1106, Wis. Stats.

Contact Us

MS 6-97

Wisconsin Department of Revenue

Office of Technical and Assessment Services

PO Box 8971

Madison, WI 53708-8971

Phone: (608) 266-7750

Email: tif@wisconsin.gov