-

What is the new qualified production activities income limitation and when is it effective?

2017 Act 59 created

sec. 71.07(5n)(d)3., Wis. Stats., effective for taxable years beginning on or after January 1, 2017. In computing the manufacturing and agriculture credit, the amount of qualified production activities income is reduced by the qualified production activities income taxed by another state upon which the credit for net tax paid to the other state is claimed under

sec. 71.07(7), Wis. Stats.

-

How does a shareholder of a tax-option (S) corporation or partner of a partnership report the qualified production activities income limitation on Schedule MA-M or MA-A?

Assuming the shareholder or partner is only eligible for the manufacturing and agriculture credit based on the credit passed through from the tax-option (S) corporation or partnership, Schedule MA-M or MA-A is completed as follows:

- The shareholder or partner does not complete lines 1-16.

- The shareholder or partner must recompute the available credit based on the information the tax-option (S) corporation or partnership provides on the Schedules 5K-1, line 17d or 3K-1, line 20c (or supplemental schedule).

- After recomputing the credit by reducing the qualified production activities income by the amount used to compute the credit for taxes paid to other states, the shareholder or partner enters the recomputed credit on line 17.

- The remaining lines of Schedule MA-M or MA-A are completed as necessary, including the business income limitation in Part II.

-

How does a tax-option (S) corporation or partnership report the qualified production activities income limitation on Schedule MA-M or MA-A?

The tax-option (S) corporation or partnership does not complete line 15f on Schedule MA-M or MA-A. The tax-option (S) corporation and partnership must provide the shareholders and partners with the amount of qualified production activities income that is taxable to another state and for which the credit for taxes paid to the other state may be claimed. Provide this information on Schedules 5K-1, line 17d or 3K-1, line 20c; or provide a supplement schedule with the Schedule K-1's.

-

Can a taxpayer elect to not claim the credit for tax paid to other states (TPOS credit) and claim the full amount of eligible qualified production activities income (QPAI) to compute the manufacturing and agriculture tax credit?

Yes. QPAI is only required to be reduced by the amount of income that is also used to compute the TPOS credit. If the taxpayer elects to not claim the TPOS credit, the limitation in

sec. 71.07(5n)(d)3., Wis. Stats., does not apply.

-

If a taxpayer has qualified production activities income (QPAI) and other income taxable in another state, can the taxpayer claim the credit for taxes paid to other state (TPOS credit) using only the other income?

Yes. The taxpayer may compute the manufacturing and agriculture credit using the QPAI, and use the remaining income taxable in the other state to compute the TPOS credit. The instructions for Schedule OS provide notes on lines that must be adjusted to compute the TPOS credit on only the remaining taxable income (non-QPAI) in the other state.

-

Is Part II of Schedules MA-M and MA-A used to limit the manufacturing and agriculture credit when the same qualified production activities income (QPAI) is used to compute the credit for tax paid to other states (TPOS)?

No. Part II of Schedules MA-M and MA-A is only used by individuals and fiduciaries to limit the manufacturing and agriculture credit that may be used to offset tax. Individuals and fiduciaries enter on line 15f of Schedules MA-M and MA-A the amount of qualified production activities income taxed by another state and used to claim the TPOS credit. Shareholders in a tax-option (S) corporation and partners in a partnership enter the recomputed credit on line 17.

-

The pass-through entity did not provide me with the amount of pass-through income that is considered qualified production activities income (QPAI). If the Wisconsin apportionment percentage is 16%, may I use the inverse of the Wisconsin apportionment percentage (84%) to reduce the QPAI for the amount used to claim the TPOS credit?

No. The apportionment percentage is not an accurate measure of the amount of QPAI taxed in the other state. You will need to contact the pass-through entity to obtain the amount of QPAI income that was included in total pass-through income and taxable in the other states.

-

How do I compute the following?

-

The qualified production activities income (QPAI) limitation when the tax-option (S) corporation or partnership derives income from the sale of QPAI that is taxed at both the individual and entity level in multiples states.

-

The credit for taxes paid to other state (TPOS credit) using non-QPAI.

Facts:

- A tax-option (S) corporation manufactures tangible personal property in Wisconsin on property assessed as manufacturing under

sec. 70.995, Wis. Stats.

- The tax-option (S) corporation sells the property in Wisconsin, California, Illinois, and Minnesota.

- There is one shareholder of the tax-option (S) corporation.

- Information provided to the shareholder on Schedule 5K-1 shows QPAI of $1,151,937, total Wisconsin income of $1,925,328 and a manufacturing credit of $86,395.

- The tax-option (S) corporation files income/franchise tax returns in other states showing the following:

| S-Corporation Composite Return: | Income: | Net Taxes Paid: |

|---|

| California (Form 540NR) | $ 954,450 | $126,942 |

| Illinois (Form IL 1023-C) | $ 375,316 | $ 18,578 |

| Minnesota (Form M3) | $ 115,750 | $ 11,401 |

| Total Income/Net Taxes Paid | $1,445,516 | $156,921 |

| S-Corporation Income and Franchise Return: | Income: | Net Taxes Paid: |

|---|

| California (Form 100S) | $ 896,450 | $ 79,246 |

| Illinois (Form IL-1120-ST) | $ 375,316 | $ 29,087 |

| Total Income/Net Taxes Paid | $1,271,766 | $108,333 |

-

The qualified production activities income (QPAI) limitation when the tax-option (S) corporation or partnership derives income from the sale of QPAI that is taxed at both the individual and entity level in multiples states.

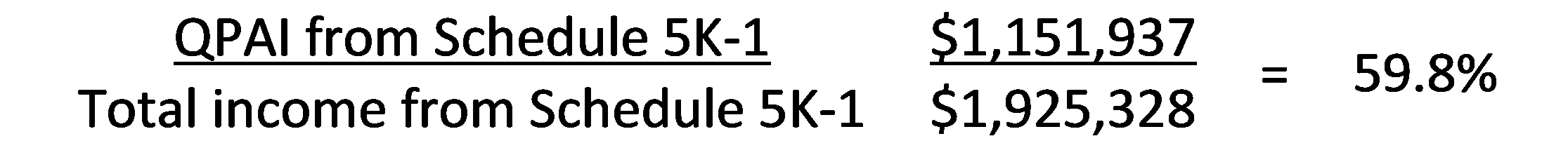

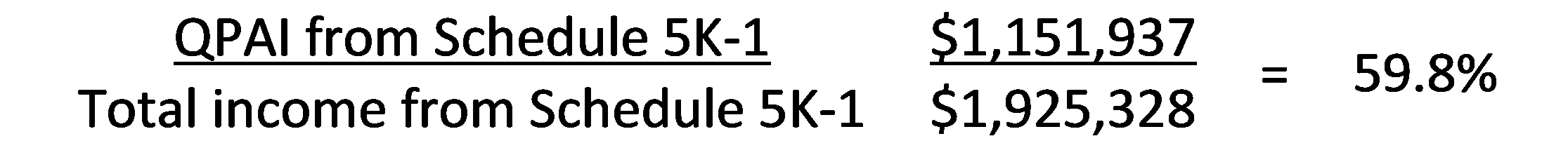

Assuming the ratio of QPAI to taxable income is the same for each state, a ratio may be computed as follows to determine the amount of QPAI taxable to the other states:

| Shareholder's share of QPAI | $1,151,937 |

Less: QPAI used to claim TPOS credit

($1,445,516 x 59.8%) | -864,419 |

| Adjusted QPAI | $287,518 |

| Multiplied by: credit rate | 7.5% |

| Manufacturing and agriculture credit | $21,564 |

The shareholder enters the $21,564 manufacturing and agriculture credit on line 17 of Schedule MA-M/MA-A and includes a schedule showing how the QPAI limitation was computed. Note that the $1,271,766 of income taxed at the entity-level in other states does not reduce the QPAI; this income is taxed on the composite individual income tax return and already accounted for in the reduction to QPAI.

-

The credit for taxes paid to other state (TPOS credit) using non-QPAI.

Assuming the ratio of QPAI to taxable income is the same for each state, a ratio may be computed as follows to determine the amount of QPAI taxable to the other states:

| CA | IL | MN | Total | Description |

|---|

| $954,450 | $375,316 | $115,750 | $1,445,516 | Total income taxable to WI and other states |

| -570,761 | -224,439 | -69,219 | -864,419 | Less: QPAI (Total income above x 59.8%) |

| $383,689 | $150,877 | $46,531 | $581,097 | Adjusted (non-QPAI) income taxable to WI and other states. See the line-by-line instructions for Schedule OS. |

-

Using the facts from above, how is the qualified production activities income (QPAI) limitation computed if the shareholder's ownership percentage is 30%?

If the tax-option (S) corporation provided the total company amounts to the shareholder, the shareholder multiplies the QPAI used to claim the TPOS credit by their ownership percentage.

| Shareholder's share of QPAI ($1,151,937 x 30%) | $345,581 |

Less: QPAI used to claim TPOS credit

($1,445,516 x 59.8% x 30%)

| -259,326 |

| Adjusted QPAI | $86,255 |

| Multiplied by: credit rate | 7.5% |

| Manufacturing and agriculture credit | $ 6,469 |

-

If a tax-option (S) corporation pays an entity-level income or franchise tax to another state, is the credit for taxes paid to the other state (TPOS credit) limited to the taxpayer's Wisconsin net tax multiplied by a ratio of the taxpayer's income subject to tax in Wisconsin and the other state to the taxpayer's Wisconsin adjusted gross income?

Yes. Schedule OS, Part III, provides the computation of the allowable credit. However, this TPOS credit limitation does not apply to taxes paid to Illinois, Iowa, Michigan, or Minnesota.