-

How does an electing partnership determine the situs of income?

The situs of income for an electing partnership is determined as if the election under sec.

71.21(6)(a), Wis. Stats., was not made. Therefore, an electing partnership must determine income attributable to Wisconsin according to sec.

71.04,

71.14,

71.25,

71.362, or

71.45 Wis. Stats., depending on the type of partner.

Example 1 - Determining Wisconsin Sourced Income in a Single-Tiered Structure:

Facts

- Partners A and B each have 50-percent ownership interest in Partnership

- Partner A was a Wisconsin resident for the entire taxable year

- Partner B was a nonresident of Wisconsin for the entire taxable year

- During the taxable year, 25 percent of the partnership's income is earned in Wisconsin and 75 percent is earned in other states

- Partnership has $100,000 of net ordinary business income during the taxable year from the sale of tangible personal property

- Partnership makes an election under sec. 71.21(6)(a), Wis. Stats., to pay tax at the entity level for the taxable year

Computation of income attributable to Wisconsin

| | Partner A (resident) | Partner B (nonresident) |

|---|

| Portion of business income from partnership | $50,000 | $50,000 |

|---|

| Wisconsin apportionment % (situs of income) | 100%

| 25% |

|---|

| Partnership’s Wisconsin source income |

$50,000 |

$12,500 |

|---|

The electing partnership's Wisconsin income is

$62,500 ($50,000 + $12,500).

Example 2 - Determining Wisconsin Sourced Income in a Multi-Tiered Structure:

Note: For multi-tiered entity tax calculations, the electing partnership must include a supplemental schedule with

Form 3,

Wisconsin Partnership Return, showing how the tax is being computed.

Facts

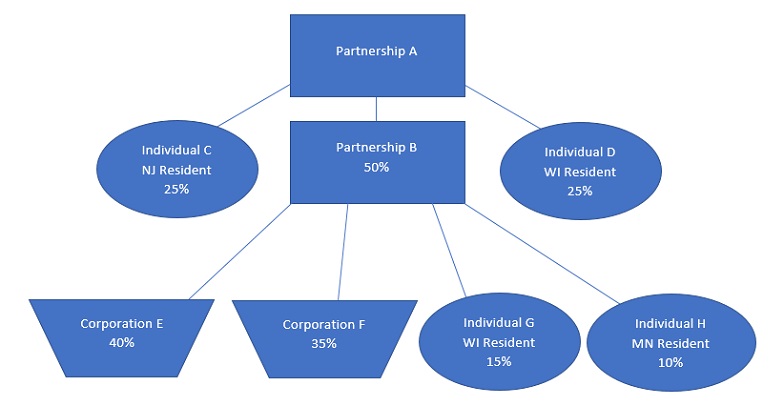

- Partnership A operates a unitary business in California, New Jersey, and Wisconsin.

- Partnership A has three partners:

- Partnership B is a 50% partner

- Individual C is a 25% partner and a resident of New Jersey

- Individual D is a 25% partner and a resident of Wisconsin

- Partnership A has $20,000,000 of federal ordinary business income, no Wisconsin adjustments, and sales of tangible personal property as follows:

| California sales (has nexus) | $15,000,000 | 30% |

|---|

| New Jersey sales (has nexus) | $7,500,0000 | 15% |

|---|

| Wisconsin sales (has nexus) | $27,500,000 | 55% |

|---|

| Sales to other states | $0 | |

|---|

| Total sales | $50,000,000 | |

|---|

- Partnership A elects to pay tax at the entity-level under sec. 71.21(6)(a), Wis. Stats.

- Partnership B has four partners

- Corporation E is a 40% partner

- Corporation F is a 35% partner

- Individual G is a 15% partner and a resident of Wisconsin

- Individual H is a 10% partner and a resident of Minnesota

- Partnership B has no additional business activity other than its interest in Partnership A.

- All income and expense amounts of Partnerships A and B are allocated to each partner on a pro-rata basis based on ownership percentage.

- Corporations E and F both conduct business in Wisconsin and New York. The Wisconsin apportionment percentages for these corporations are as follows, after combining their share of the partnership's apportionment data with their own apportionment data:

- Corporation E 30%

- Corporation F 40%

Taxable Income: If Partnership A makes the election, it will owe tax on $12,400,000 of Wisconsin taxable income. See the computations in Tables 1 and 2 below.

Organizational Structure:

Table 1: Partnership A's Computation of Income Attributable to Wisconsin:

| Partnership B | Individual C

NJ Resident | Individual D

WI Resident | Total |

|---|

| Ownership % in Partnership A | 50% | 25% | 25% | 100% |

|---|

| Business income | $10,000,000 | $5,000,000 | $5,000,000 | $20,000,000 |

|---|

| WI apportionment | N/A | 55% | N/A | |

|---|

| WI taxable income | $4,650,000

(see Table 2) | $2,750,000 | $5,000,000 |

$12,400,000 |

|---|

Table 2: Partnership B's Partners' Computation of Income Attributable to Wisconsin:

| Corporation E | Corporation F | Individual G

WI Resident | Individual H

MN Resident | Total |

|---|

| Ownership % in Partnership B | 40% | 35% | 15% | 10% | 100% |

|---|

| Business income | $4,000,000 | $3,500,000 | $1,500,000 | $1,000,000 | $10,000,000 |

|---|

| WI apportionment | 30% | 40% | N/A | 55% | |

|---|

| WI taxable income | $1,200,000 | $1,400,000 | $1,500,000 | $550,000 |

$4,650,000 |

|---|

-

What is the entity-level tax rate?

The net income reportable to Wisconsin is taxed at 7.9% as provided in sec.

71.21(6)(a), Wis. Stats., and is computed on

Schedule 3-ET,

Entity-Level Tax Computation.

-

Are long-term capital gains taxed at a different rate?

No, there is no separate tax rate for long-term capital gains.

-

Can an electing partnership claim the 30-percent or 60-percent long-term capital gain exclusion for Wisconsin?

Yes, an electing partnership may claim the Wisconsin 30-percent or 60-percent long-term capital gain exclusion for the portion of long-term capital gain allocable to partners that would have been allowed the deduction if the entity-level tax election had not been made. For example, the long-term capital gain allocable to corporate partners would not be allowed the Wisconsin 30-percent or 60-percent long-term capital gain deduction at the entity level.

According to sec.

71.21(6)(d)1., Wis. Stats., an electing partnership computes net income as provided in secs. 71.21(1) to (5), Wis. Stats. According to sec.

71.21(1), Wis. Stats., net income of a partnership is computed in the same manner and on the same basis as provided for computation of the income of persons other than corporations. Therefore, the partnership may claim the 30-percent and 60-percent long-term capital gain deductions under secs.

71.05(6)(b)9. and

9m., Wis. Stats.

According to sec.

71.21(6)(b), Wis. Stats., it is the intent of the election that the partnership shall pay tax on items that would otherwise be taxed if the election was not made.

-

Is an electing partnership eligible to claim an exclusion of long-term capital gains from the sale of an investment in a qualified Wisconsin business or Wisconsin qualified opportunity fund?

No, according to secs.

71.05(25)(a)1., and

(25m)(a)1., Wis. Stats., a claimant must be an individual.

-

Can an electing partnership register to be a qualified Wisconsin business?

Yes, an electing partnership may register to be a qualified Wisconsin business if they otherwise qualify. See

Registration of Qualified Wisconsin Businesses common questions on the department's website.

-

Can an electing partnership claim a deduction for charitable contributions?

No, an electing partnership may not deduct charitable contributions except for charitable contributions that would otherwise be allowed as a deduction for a fiduciary as provided in sec.

642, Internal Revenue Code (IRC).

According to sec.

71.21(6)(d)1., Wis. Stats., an electing partnership computes net income as provided in secs. 71.21(1) to (5), Wis. Stats. According to sec.

71.21(1), Wis. Stats., net income of a partnership is computed in the same manner and on the same basis as provided for computation of the income of persons other than corporations. Section

71.01(9), Wis. Stats., defines person as a natural person or fiduciary.

-

Can an electing partnership pass through charitable contributions to its partners?

No, an electing partnership may not pass through charitable contributions to its partners.

According to secs.

71.21(6)(d)1.,

71.21(1),

71.01(9), Wis. Stats., and sec.

642, IRC, charitable contributions are included in an electing partnership's net income, and therefore may not pass through to the partners.

-

Is an electing partnership subject to its partners' basis limitations when determining the amount of deductions or losses allowable in computation of net income of the partnership?

Yes. According to sec.

71.21(6)(b), Wis. Stats., it is the intent that an electing partnership must pay tax on items that would otherwise be taxed if the election was not made. According to sec.

71.21(6)(d)4., Wis. Stats., a partner's adjusted basis of the partner's interest in an electing partnership is determined as if the election was not made.

Since basis limitations affect the amount of income that would otherwise be taxed on the partner's return, such limitations also affect the amount of net income of the partnership that is subject to tax when the partnership elects to pay tax at the entity level. See Example below.

Facts:

Partnership XYZ:

- Owned equally by individual partners A and B (50-percent ownership interest each)

- Calendar-year filer

- Only does business in Wisconsin

- Makes the entity-level tax election under sec.

71.21(6)(a), Wis. Stats.

Individual Partner A:

- Full-year Wisconsin resident with the following information during the calendar year:

- Beginning basis of ownership interest in XYZ: $75,000

- Ordinary business income or (loss) from XYZ: ($50,000)

- Guaranteed payments from XYZ: $100,000

- No other items of income, gain, loss, or deduction

Individual Partner B:

- Full-year Wisconsin resident with the following information during the calendar year:

- Beginning basis of ownership interest in XYZ: $5,000

- Ordinary business income or (loss) from XYZ: ($50,000)

- No other items of income, gain, loss, or deduction

Computation of Net Income:

Partnership XYZ:

| Partner A's guaranteed payments from XYZ: | $100,000 |

|---|

| Partner A's allowable losses from XYZ: | ($50,000) |

|---|

| Partner B's allowable losses from XYZ: | ($5,000) |

|---|

| Net income for Partnership XYZ: | $45,000 |

|---|

Computation of Suspended Losses Due to Basis Limitation:

Partnership XYZ:

$45,000 of suspended losses ($5,000 - $50,000) due to Partner B's basis limitation is suspended at the entity level in Partnership XYZ because the entity-level tax election was made. Partnership XYZ may be able to claim the suspended losses in a future year using Partner B's adjusted basis. However, Partnership XYZ must make the entity-level tax election for that year and Partner B's adjusted basis in Partnership XYZ must be reduced by the amount of suspended losses claimed by Partnership XYZ.

Computation of Basis:

Partner A:

$25,000 [$75,000 (beginning basis) – ordinary business loss of $50,000] of Wisconsin basis in Partnership XYZ

Partner B:

$0 [$5,000 (beginning basis) – ordinary business loss of $5,000 because basis cannot go below zero] of Wisconsin basis in Partnership XYZ

-

Is an electing partnership subject to passive activity loss limitations?

Yes, an electing partnership is subject to passive activity loss limitations as provided in sec.

469, IRC.

According to sec.

71.21(6)(d)1., Wis. Stats., an electing partnership computes net income as provided in secs. 71.21(1) to (5), Wis. Stats. According to sec.

71.21(1), Wis. Stats., net income of a partnership is computed in the same manner and on the same basis as provided for computation of the income of persons other than corporations. Section

71.01(9), Wis. Stats., defines person as a natural person or fiduciary. According to sec.

469(a)(1) and (2), IRC, passive activity loss limitations apply to any individual estate, or trust.

-

How does the electing partnership determine the characterization of passive income or loss?

The electing partnership must determine the characterization of passive income or loss as if the election under sec.

71.21(6)(a), Wis. Stats., was not made. Therefore, an electing partnership must determine how each partner would characterize the income or loss as if the election was not made. Passive losses may not be passed through to the partners; however, suspended losses may be carried forward by the electing partnership to be used to offset income in a subsequent year in which the election is made.

The electing partnership must complete a pro forma federal Form 8582, Passive Activity Loss Limitations, for Wisconsin in order to determine the allowable passive activity losses it may claim.

According to sec.

71.21(6)(d)1., Wis. Stats., an electing partnership computes net income as provided in secs. 71.21(1) to (5), Wis. Stats. According to sec.

71.21(1), Wis. Stats., net income of a partnership is computed in the same manner and on the same basis as provided for computation of the income of persons other than corporations. Section

71.01(9), Wis. Stats., defines person as a natural person or fiduciary. According to sec.

71.21(6)(b), Wis. Stats., it is the intent that an electing partnership must pay tax on items that would otherwise be taxed if the election was not made.

-

What is the capital loss limitation for an electing partnership?

For taxable years beginning on or after January 1, 2019, and before January 1, 2023, an electing partnership is subject to a $500 capital loss limitation.

For taxable years beginning on or after January 1, 2023, an electing partnership is subject to a $3,000 capital loss limitation.

Capital losses may not be passed through to the partners; however, suspended losses may be carried forward by the electing partnership to be used to offset income in a subsequent year in which the election is made, to the extent allowed under Wisconsin law.

According to sec.

71.21(6)(d)1, Wis. Stats., an electing partnership computes net income as provided in secs. 71.21(1) to (5), Wis. Stats. According to sec.

71.21(1), Wis. Stats., net income of a partnership is computed in the same manner and on the same basis as provided for computation of the income of persons other than corporations. Section

71.01(9), Wis. Stats., defines person as a natural person or fiduciary.

-

Is an electing partnership subject to federal section 179 expense limitations?

Yes, an electing partnership is subject to federal section 179 expense limitations as provided in sec.

71.98, Wis. Stats. The limit is applied at the entity level.

-

Is an electing partnership allowed the federal special depreciation allowance or "bonus depreciation" under sec. 168(k), Internal Revenue Code (IRC)?

No, according to secs.

71.01(6)(m) and

71.98, Wis. Stats., an electing partnership may not claim the federal special depreciation allowance provided in sec. 168(k), IRC.

-

How will depreciation that results from a partnership's election under sec. 754, IRC, be treated if the partnership makes an election to be taxed at the entity level?

The adjustment to partnership income as a result of a section

754, IRC, election is included in the electing partnership's calculation of Wisconsin income when determining tax at the entity level. This includes the election applied under both secs.

734(b) and

743(b), IRC.

The partnership includes the depreciation in the calculation of its Wisconsin income according to secs.

71.01(6)(m) and

71.98, Wis. Stats., regardless if the entity-level tax election is made.

-

Can an electing partnership carry forward suspended capital and passive activity losses?

Yes, an electing partnership may carry forward suspended capital and passive activity losses. When the election is made, such losses may not pass through to partners; they are suspended until such time that the partnership may use them to offset income in a subsequent year in which the election is made.

-

Can an electing partnership carry back or carry forward net operating losses?

No, according to sec.

71.21(6)(d)2., Wis. Stats., an electing partnership may not claim net operating losses under sec.

71.05(8), Wis. Stats.

-

Can an electing partnership pass through net operating or business losses to its partners?

No, partners of an electing partnership may not include in their Wisconsin adjusted gross income their proportionate share of items of income, gain, loss, or deduction of the partnership, according to sec.

71.21(6)(b), Wis. Stats.

-

Can an electing partnership claim credits to offset taxable income at the entity level?

According to sec.

71.21(6)(d)3., Wis. Stats., an electing partnership may only claim a credit for other state taxes paid as provided under sec.

71.07(7)(b)3., Wis. Stats.

-

Can an electing partnership pass through credits to its partners?

Yes, an electing partnership may pass through credits to its partners, except for the credit for taxes paid to other states by the partnership as provided in sec.

71.07(7)(b)2., Wis. Stats.

-

How is the manufacturing and agriculture (M&A) credit included in Wisconsin income if a partnership makes an election to pay tax at the entity level in the year the M&A credit is computed and does not make the election to pay tax at the entity level in the following year?

The M&A credit must be added to the partnership's income for the year following the year in which the credit was computed as provided in sec.

71.21(4)(b), Wis. Stats., regardless of whether the partnership makes the election to pay tax at the entity level.

-

How does an electing partnership compute the credit for taxes paid to another state?

An electing partnership must use

Schedule ET-OS,

Credit for Net Tax Paid to Another State, to compute the allowable credit for taxes paid to another state. See Schedule ET-OS instructions for additional information.

-

Can an electing partnership claim a credit for taxes paid to another state if the taxes paid to the other state are paid by a partner on an individual income tax return?

No, in order for an electing partnership to receive credit for taxes paid to another state, the partnership must pay the taxes owed to the other state on a partnership income or franchise tax return, or pay tax to the other state on a composite return filed on behalf of its partners as provided in sec.

71.07(7)(b)3., Wis. Stats.

-

Is withholding tax paid by an electing partnership in another state (e.g., Illinois) on behalf of its members considered a "composite return" for purposes of the Wisconsin entity-level credit for taxes paid to another state?

A partnership may claim a credit for withholding taxes paid to another state on behalf of a Wisconsin resident partner as provided in sec.

71.07(7)(b)3., Wis. Stats., if all of the following apply:

- The law in the other state provides that the Wisconsin resident is not required to file an individual income tax return because the individual's net income tax liability is considered paid in full as a result of the withholding tax paid by the entity on the Wisconsin partner's income attributable to the other state.

- The Wisconsin resident does not file an individual income tax return in the other state.

Caution: Although the individual is not required to file an Illinois income tax return, the individual may file such return with Illinois.

- The income taxed by the other state is attributable to amounts that would be reportable to Wisconsin if the entity-level tax election was not made.

- The partnership pays the liability shown on the other state's withholding tax return. Amounts paid to the other state are considered paid to that other state only in the year in which the withholding tax return for that state was required to be filed.

- The partnership includes a copy of the other state's withholding tax return to its Wisconsin Form 3.

- The credit is claimed within four years of the unextended due date of the entity's return.

For example, Illinois law provides that a nonresident of Illinois who has had Illinois income tax withheld by a partnership is not required to file an Illinois individual income tax return if the nonresident's income tax liability is paid in full after taking into account the withholding.

-

Can a partnership making the election to pay tax at the entity level exclude income at the entity level if the income is attributable to a tax-exempt partner?

No, according to sec.

71.21(6)(d)1, Wis. Stats., an electing partnership computes net income as provided in secs. 71.21(1) to (5), Wis. Stats. According to sec.

71.21(1), Wis. Stats., net income of a partnership is computed in the same manner and on the same basis as provided for computation of the income of persons other than corporations. Section

71.01(9), Wis. Stats., defines person as a natural person or fiduciary.

-

For Wisconsin purposes, how will the partnership entity-level tax election affect the deductible amount of a partner's interest expense related to a debt-financed acquisition of a partnership?

The interest paid by the partner is an expense incurred by the partner; it is not an expense of the partnership. The deductibility of the interest expense on the partner's Wisconsin income tax return is determined under the Internal Revenue Code (IRC) in effect for Wisconsin. The partner may deduct the interest expense to the extent allowable under Internal Revenue Service treas. reg. sec.

1.163-8T, and secs.

163(d) and

469, IRC, in effect for Wisconsin, regardless of whether the partnership makes an election under sec.

71.21(6)(a), Wis. Stats., to pay tax at the entity level.

-

For Wisconsin purposes, how will the partnership entity-level tax election affect the deductible amount of a partner's unreimbursed partnership expenses (UPE) reported on federal Schedule E, page 2?

The UPE paid by the partner is an expense incurred by the partner; it is not an expense of the partnership. The deductibility of the UPE expense on the partner's Wisconsin income tax return is determined under the IRC in effect for Wisconsin. The partner may deduct the UPE to the extent allowable under the IRC in effect for Wisconsin, regardless of whether the partnership makes an election under sec.

71.21(6)(a), Wis. Stats., to pay tax at the entity level.

-

Is an electing partnership subject to Wisconsin franchise tax on federal, state, and municipal government interest that would otherwise be taxable to a partner that is a tax-option (S) corporation?

Yes, according to sec.

71.21(6)(b), Wis. Stats., an electing partnership must pay tax on items that would otherwise be taxed if the election was not made. Therefore, if one of the partners is a corporation that would otherwise be subject to a franchise tax on the federal, state, and municipal government interest, the electing partnership must pay tax on this income.

-

How are guaranteed payments treated when calculating the partnership's Wisconsin taxable income?

According to sec.

71.21(6)(b), Wis. Stats., the partnership shall pay tax on items that would otherwise be taxed if the election was not made. Accordingly, to the extent a partner would otherwise include the guaranteed payments in Wisconsin taxable income, the electing partnership must include the guaranteed payments in Wisconsin taxable income.

-

Can an electing partnership deduct from partnership income the health insurance premiums allowed as a deduction from a partner's income as self-employed health insurance according to sec. 162(I), IRC?

No, the deductibility of self-employed health insurance as provided in sec.

162(l), IRC, is only allowed on the partner's Wisconsin income tax return to the extent allowable under the IRC in effect for Wisconsin, regardless of whether the partnership makes an election under sec. 71.21(6)(a), Wis. Stats., to pay tax at the entity level.

-

Can an electing partnership deduct from partnership income retirement contributions paid by the partnership on behalf of a partner (i.e., the partnership reduces the amount of a partner's cash distributions to make retirement contributions)?

No, the deduction for retirement plan contributions as provided in sec.

404(a)(8), of the Internal Revenue Code (IRC), is only allowed on the partner's Wisconsin income tax return to the extent allowable under the IRC in effect for Wisconsin, regardless of whether the partnership makes an election under sec. 71.21(6)(a), Wis. Stats., to pay tax at the entity level.

-

Can an electing partnership deduct from partnership income the federal one-half of self-employment tax deduction provided in sec. 164(f), IRC?

No, the federal deduction for one-half of self-employment taxes resulting from a partnership's federal taxable income as provided in sec.

164(f), IRC, may not be claimed by the partnership. However, the partner is allowed the deduction for Wisconsin purposes to the extent allowable under the IRC in effect for Wisconsin.

-

If a partner of an electing partnership had a suspended loss from a prior year due to basis limitations, may the electing partnership use the partner's suspended loss to reduce its Wisconsin taxable income in the current year?

No, an electing partnership may not use a partner's suspended loss from prior years when computing Wisconsin taxable income. Suspended loss due to a basis limitation occurs when a partner is disallowed business loss passed-through from a partnership because the partner does not have enough tax basis in the entity.

Note: According to sec. 71.21(6)(d)4., Wis. Stats., a partner's adjusted basis of the partner's interest in an electing partnership is determined as if the election was not made. Therefore, a partner with prior year suspended losses due to basis limitations may be able to deduct a portion of the suspended losses in a year the partner's basis in the partnership increases, regardless if the partnership makes the entity-level tax election.