November 5, 2021

To: Real Property Listers, County Treasurers

The Wisconsin Department of Revenue (DOR) posted the 2022 Assessment and Tax Roll XML instructions to our website.

2021 Final Tax Roll Submission – Due March 15, 2022

-

2021 Wisconsin Act 55 requires the county treasurer to provide DOR with the complete county tax roll by March 15 each year

- Submit your 2021 county tax roll to DOR no later than March 15, 2022

2022 Assessment and Tax Roll XML Schema

- No schema changes for 2022

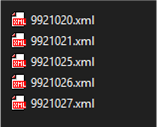

- Submit one real estate XML and one personal property XML for each municipality

- Name each XML with its corresponding DOR Co-muni code – to improve the XML names and quickly identify which file belongs to a specific municipality

- Submit one real estate XML and one personal property XML for each municipality – to make the XML easier to locate when working together to troubleshoot issues

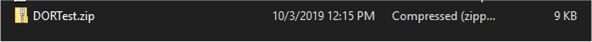

- Upload the county – send a zip file with all municipality XML included

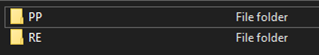

- Send a single zipped file for each real estate XML and each personal property XML

- Make sure the zipped file only contains xml files

- Do not include internal folders in your zip file

- Send DOR your public (redacted) data to maintain consistency with providing any data

Filing Assistance Updates

- Can submit real estate XML with one parcel (ex: Counties with a split municipality and the XML has one real estate parcel in the XML)

- Acknowledgement emails now contain parcel numbers when an XML does not meet the schema requirements

- See our filing assistance document available our

website

Questions?

Contact us at otas@wisconsin.gov.