Is my unemployment compensation taxable for Wisconsin?

Wisconsin law may allow you to subtract a certain amount of unemployment compensation that is included in your federal adjusted gross income, if your federal adjusted gross income exceeds a certain base amount (sec.

71.05(6)(b)8., Wis. Stats.). For purposes of computing the subtraction, your federal adjusted gross income includes the amount of unemployment compensation you received but does not include any amount of taxable social security benefits received or taxable refunds, credits, or offsets. Your federal adjusted gross income must exceed the following base amounts, depending on your filing status:

- Single (unmarried) - $12,000

- Married filing joint return - $18,000

- Married filing separate return and did not live with your spouse at all during the year - $12,000

- Married filing separate return and lived with your spouse at any time during the year - $0

How do I figure the amount of unemployment compensation I can subtract for Wisconsin?

The amount of unemployment compensation which is taxable for Wisconsin is equal to the lesser of the following:

- One-half of the amount of excess unemployment compensation over the base amount

- The amount of unemployment compensation received during the year

To figure the subtraction amount, complete the worksheet in the

Schedule SB instructions or

Schedule M instructions.

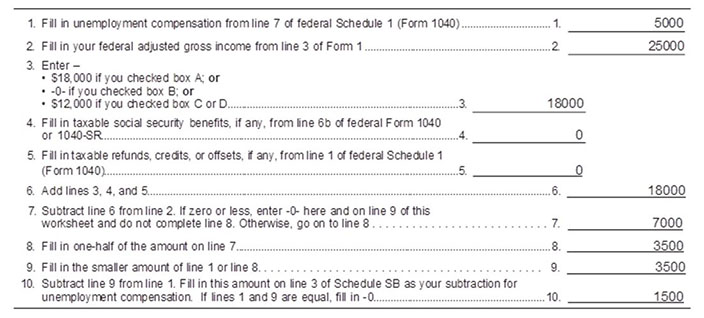

Example: You and your spouse are full-year Wisconsin residents and are married filing a joint return. You received $5,000 of unemployment compensation for the year 2025. You and your spouse's federal adjusted gross income is $25,000. This amount does not include any social security benefits or taxable refunds, credits, or offsets. The worksheet is completed as follows (this worksheet refers to the 2025 Schedule SB):

In this example, only $3,500 of your unemployment compensation is taxable. Therefore, you would enter "1500" as a subtraction on 2025 Schedule SB, line 3.

Where is my unemployment compensation reported on my 2025 income tax return?

For federal purposes, the amount of unemployment compensation received is reported on 2025 Form 1040 or 1040-SR, Schedule 1, Line 7.

For full-year residents of Wisconsin, the federal amount for Wisconsin purposes is included on 2025 Form 1, Line 3.

Note: Full-year residents of Wisconsin may qualify for a subtraction modification (see

Schedule SB and the related

instructions).

For part-year or nonresidents of Wisconsin, the federal amount for Wisconsin purposes is reported on 2025 Form 1NPR, line 13, column A, and the Wisconsin sourced amount is reported on line 13, column B.

Note: Part-year residents of Wisconsin may qualify for a subtraction modification (see

Schedule M and the related

instructions). Nonresidents are ineligible for the subtraction since no unemployment compensation, which is sourced to the state of residence when received, is sourced and taxable to Wisconsin.

Will I receive a form indicating my total unemployment compensation received from Wisconsin for 2025?

You will be sent a 2025 Form 1099-G by January 31, 2026. The amount of unemployment compensation you received during calendar year 2025 is reported in box 1 of Form 1099-G. You may also view and print Form 1099-G online. For additional information, go to the Department of Workforce Development's

1099-G Tax Information page.

Note: Any unemployment compensation payment received by an individual in 2026 is not taxable in 2025, regardless of whether the payments are relating to a period of unemployment in 2025. An individual who receives payments in 2026 will be sent a 2026 Form 1099-G and should report the appropriate amounts on their 2026 federal and Wisconsin income tax returns.

Are Wisconsin income taxes withheld from my unemployment compensation?

Wisconsin income taxes are only withheld from your unemployment compensation upon request. For more information and to make a request, visit the Department of Workforce Development's

Federal and State Income Tax Withholding page.

Do I need to make estimated income tax payments?

If you do not request to have Wisconsin income taxes withheld, you may need to make Wisconsin estimated income tax payments. Review the

2026 Form 1-ES instructions to determine if estimated tax payments are required.