-

How will making the election impact a partner's adjusted basis in the interest of an electing partnership?

The adjusted basis of a partner's interest in an electing partnership is determined as if the election was not made as provided in sec.

71.21(6)(d)4., Wis. Stats.

-

Can partners use the Wisconsin manufacturing and agriculture credit from an electing partnership to offset their Wisconsin individual income tax liability for the same taxable year?

No, a partner may only use the manufacturing and agriculture credit to offset a partner's tax liability resulting from the partner's prorated share of the partnership's income as provided in sec.

71.07(5n)(c)3., Wis. Stats. Since a partner of an electing partnership does not have income and resulting tax from the partnership in the year of the election, the partner cannot use the credit to offset income tax liability from other sources of income. The partner may carry forward the credit for 15 years and use the credit to offset tax liability resulting from the partner's prorated share of taxable income from the partnership for a year in which the election is not made.

-

If a partnership makes the entity-level tax election, can an individual Wisconsin resident partner claim a credit for taxes paid to another state on the income from the electing partnership?

No, an individual resident partner may not claim a credit for taxes they paid to another state against Wisconsin income taxes paid by the entity.

-

How is the Wisconsin credit for taxes paid to other states (TPOS) calculated if a lower-tier entity makes the entity-level tax election but the upper-tier entity does not make the entity-level tax election?

See example below.

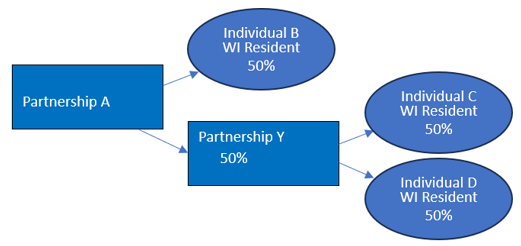

Organization Structure:

Facts:

- Partnership A (i.e., the "lower-tier entity"):

- Operates a unitary business in Wisconsin and State ZZ

- Has two equal partners:

- Individual B is a full-year Wisconsin resident

- Partnership Y

- Elects to pay tax at the partnership level in Wisconsin and State ZZ

- Partnership Y (i.e., the "upper-tier entity"):

- Operates a unitary business in Wisconsin and State ZZ

- Has two equal partners:

- Individual C is a full-year Wisconsin resident

- Individual D is a full-year Wisconsin resident

- Elects to pay tax at the entity level in State ZZ but not in Wisconsin

Calculation of Wisconsin TPOS Credit:

- Partnership A (lower-tier entity making entity-level tax election in Wisconsin and State ZZ): Calculate TPOS credit using

Schedule ET-OS,

Credit for Net Tax Paid to Another State, based on Partnership A's income taxable to Wisconsin and State ZZ.

- Individual partner B (partner of Partnership A): There is no TPOS credit for taxable income from Partnership A because Partnership A made the entity-level tax election in Wisconsin; therefore, Partnership A's income is not taxable to partner B in Wisconsin.

- Partnership partner Y (partner of Partnership A and making entity-level tax election in State ZZ but

not in Wisconsin): Report tax paid to State ZZ on Schedule 3K-1, line 15i. See

Form 3 instructions for Schedule 3K, line 15i.

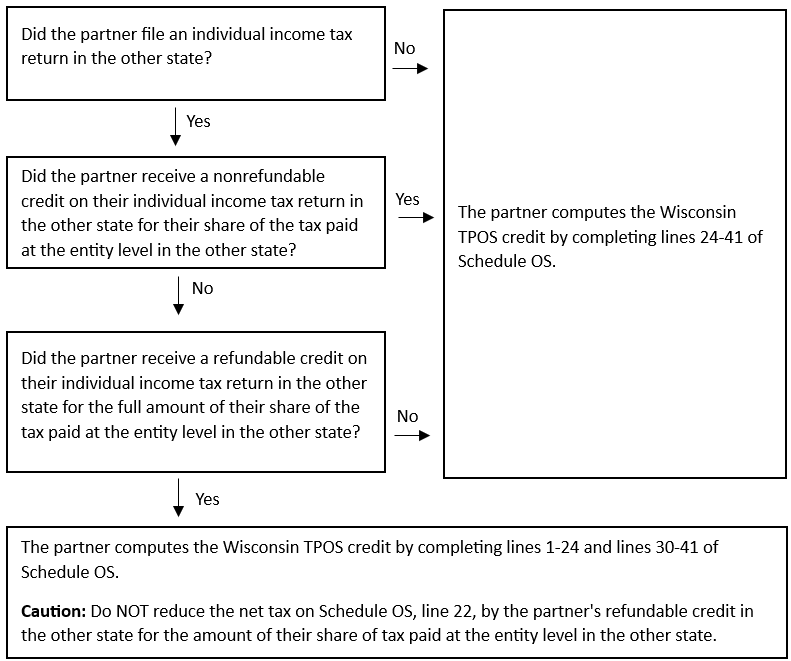

- Individual partners C and D (partners of Partnership Y): Calculate the TPOS credit using Parts III and IV of

Schedule OS,

Credit for Net Tax Paid to Another State, based on each partners' share of net tax paid by Partnership Y and Partnership Y's income taxable to Wisconsin and State ZZ.

Exception: Individual partners C and D calculate the TPOS credit using Schedule OS, lines 1-24 of Parts I, II, and III, and lines 30-41 of Part IV, if they receive a refundable credit on their individual income tax return filed with State ZZ for the full amount of tax paid by Partnership Y at the entity level in State ZZ. Do NOT reduce the net tax on Schedule OS, line 22, by individual partner C's and D's credit claimed in State ZZ for tax paid by Partnership Y in State ZZ.

See

Schedule OS instructions for more information.

-

How is the Wisconsin credit for taxes paid to other states (TPOS) calculated if a partnership does not have nexus in Wisconsin, does not file a Wisconsin income/franchise tax return, and makes an election to pay tax at the entity-level in another state?

See the flow chart below.

Note: The flow chart assumes the partner is a resident of Wisconsin and the partner's only items of income, gain, loss, and deduction are from the partnership. See the

Schedule OS instructions for more information.

-

If a partnership makes the entity-level tax election, can an individual partner claim the federal deduction for one-half of self-employment taxes resulting from the electing partnership's federal taxable income as provided in sec. 164(f), of the Internal Revenue Code (IRC), on their Wisconsin income tax return?

An individual partner is allowed the federal deduction for one-half of self-employment taxes resulting from an electing partnership's federal taxable income to the extent allowable under the IRC in effect for Wisconsin.

-

If a partnership makes the entity-level tax election, can an individual partner claim the federal deduction for self-employed health insurance premiums as provided in sec. 162(l), IRC, on their Wisconsin income tax return?

An individual partner is allowed the federal deduction for self-employed health insurance premiums to the extent allowable under the IRC in effect for Wisconsin.

-

If a partnership makes the entity-level tax election, can a partner claim a depreciation deduction as a result of a section 754, IRC, election made by the electing partnership?

No, the adjustment to partnership income as a result of a section

754, IRC, election is included in the electing partnership's calculation of Wisconsin income when determining tax at the entity level. This includes the election applied under both secs.

734(b) and

743(b), IRC.

The partnership includes the depreciation in the calculation of its Wisconsin income according to secs.

71.01(6)(m) and

71.98, Wis. Stats., regardless if the entity-level tax election is made.

-

If a partnership makes the entity-level tax election, are the individual partners required to file a Wisconsin individual income tax return if they have no income reportable to Wisconsin?

No, individual partners of an electing partnership that do not have any income reportable to Wisconsin are not required to file a Wisconsin individual tax return. However, partners must timely file a Wisconsin income tax return to claim credits or refunds.

-

If a partnership makes the entity-level tax election, are estate or trust partners required to file a Wisconsin Form 2,

Wisconsin Fiduciary Income Tax for Estates or Trusts, if they have no income reportable to Wisconsin?

Yes, according to sec.

71.13, Wis. Stats., "annual returns of income of an estate or a trust shall be made to the department by the fiduciary thereof at or before the time such income is required to be reported to the internal revenue service under the internal revenue code."

-

Are partners of an electing partnership required to include their Schedule 3K-1 with their Wisconsin individual income tax returns?

Yes, individuals are required to include a copy of the

Schedule 3K-1,

Partner's Share of Income, Deductions, Credits, etc., with their Wisconsin individual income tax return, regardless of whether the election is made.

Note: The processing of a partner's tax return may be delayed if the Schedule 3K-1 is not included with the return.

-

If a nonresident of Wisconsin is a partner of two partnerships and only one makes the entity-level tax election, can the nonresident partner participate in the Wisconsin composite return, Form 1CNP, of the non-electing partnership?

The partner may participate in the Wisconsin composite return if its only source of Wisconsin income is from the non-electing partnership, the partner is not filing a separate Wisconsin income tax return for the same taxable year, and otherwise qualifies to participate in the composite return as provided in the

Form 1CNP instructions.

-

What items reported on a Schedule 3K-1 from an electing partnership can be claimed on a partner's income tax return?

A partner may claim credits passed through from the electing partnership reported on Schedule 3K-1 lines 15a through h.

Schedule 3K-1 Credit Exceptions

- Partners may not use the taxes paid by the electing partnership, including taxes paid on the partner's behalf on a composite return, to compute a credit for tax paid to another state. In addition, a resident partner may not claim credit for taxes they paid to another state on income taxed at the entity level in Wisconsin.

- Partners may not claim the manufacturing and agriculture credit passed through from an electing partnership in the year of the election. See common question #2 above.

- Nonresident partners may not claim Wisconsin withholding passed through from an electing partnership, if the partnership claimed a refund of the pass-through withholding or submitted a written request to apply the pass-through withholding against the tax liability at the entity level.

-

What items reported on a Schedule 3K-1 from an electing partnership may not be reported on a partner’s income tax return?

All items reported on Schedule 3K-1 other than the items mentioned in common question #13 in this document.

-

If a partnership makes the entity-level tax election, how should a partner filing a Wisconsin tax return remove the proportionate share of the electing partnership's income that is taxed at the entity level?

The partner must report their federal adjusted gross income, using the Internal Revenue Code (IRC) in effect under Wisconsin law, on the partner’s Wisconsin income tax return. The partner may add or subtract from federal adjusted gross income the amount of loss or income reported by the electing partnership that is included in the federal adjusted gross income.

Example:

Facts

- Partner A was a Wisconsin resident for the entire taxable year

- Partner A owns 50 percent of Partnership

- Partner A's only sources of income for the taxable year are $15,000 of wages and $100,000 of federal ordinary business income from the partnership

- Partnership makes an election under sec. 71.21(6)(a), Wis. Stats., to pay tax at the entity level for the taxable year

- Partnership's $100,000 of federal ordinary business income for the taxable year has the following Wisconsin differences:

- $5,000 of Wisconsin tax paid by the partnership with its prior taxable year Form 3 deducted on the current taxable year federal Form 1065

- $10,000 of additional Wisconsin depreciation expense because of a different depreciable basis of an asset determined under the IRC in effect for Wisconsin purposes.

How partner A must report income and expense items from the electing partnership's Schedule 3K-1

- Partner A must:

- File

Form 1,

Wisconsin Income Tax, because Partner A was a full-year Wisconsin resident,

- Use

Schedule

I,

Adjustments to Convert Federal Adjusted Gross Income and Itemized Deductions to the Amounts Allowable for Wisconsin, to reduce federal adjusted gross income by $10,000 of additional depreciation.

- Use

Schedule AD,

Form 1 - Additions to Income, Line 30, to report the addition modification of $5,000 relating to the tax paid to Wisconsin with the prior taxable year Form 3 and deducted on the current taxable year federal Form 1065, and

- Use

Schedule SB,

Form 1 - Subtractions from Income, Line 48 to report a $95,000 subtraction modification for Wisconsin income taxed at the entity level of the partnership.

Computation of the $95,000 subtraction for Wisconsin income reported by the partnership

| Description | Amount |

|---|

| Federal ordinary business income from the partnership | $100,000

|

| Schedule

I depreciation difference | ($10,000) |

| Schedule AD (line 30) - addition modification relating to tax paid to Wisconsin and deducted on federal Form 1065 | $5,000

|

|

Schedule SB (line 48) - subtraction modification for Wisconsin income reported by the partnership |

$95,000 |

-

Can the removal of an electing partnership's income from the partner's individual income tax return create a Wisconsin net operating loss (NOL) if the partner does not have a federal NOL?

No, according to secs.

71.01(3) and

(14), Wis. Stats., an individual must have a federal NOL in order to have a Wisconsin NOL. The only exceptions are:

- If a taxpayer is a part-year or nonresident of Wisconsin and a portion of the federal adjusted gross income does not have situs in Wisconsin, or

- If a tax-option (S) corporation shareholder’s allowable deduction for their pro rata share of the corporation’s losses results in a loss on the shareholder’s Wisconsin income tax return, the loss generally will be treated in the same manner as other Wisconsin NOLs. However, unlike other Wisconsin NOLs, Wisconsin tax-option (S) corporation losses may be claimed even if the shareholder has no federal NOL.

Note: Wisconsin

Publication 120,

Net Operating Losses for Individuals, Estates, and Trusts, provides more information regarding NOL.

-

When an individual partner is determining household income for purposes of claiming the homestead credit, must the individual partner include income from a partnership making the entity-level tax election?

No, according to secs.

71.21(6)(b) and

71.52(6), Wis. Stats., income from an electing partnership is not included in the individual partner's Wisconsin adjusted gross income or household income.

-

When an individual partner is determining earned income for purposes of claiming the Wisconsin earned income credit, must the individual partner remove the items of income, gain, loss, or deduction received from the electing partnership?

No, according to sec.

71.07(9e)(aj), Wis. Stats., the Wisconsin earned income credit is based on the federal earned income credit under the IRC in effect for Wisconsin purposes.

-

If a partnership makes the entity-level tax election, do partners still need to include the partnership's apportionment factors for purposes of determining Wisconsin apportionment?

Yes, partners must generally include their share of the numerator and denominator of the partnership’s apportionment factors in the numerator and denominator of their apportionment factors.

-

If a partnership with passive income makes the entity-level tax election, how does an individual partner with a passive loss carryforward report the adjustment for the partnership's election?

The individual partner's passive loss carryforward for Wisconsin would be the same as the federal passive loss carryforward and the subtraction for the passive income from the electing partnership may be treated as a Wisconsin net operating loss (NOL) only if there is a federal NOL.

Example:

Facts

- Partner is an individual Wisconsin resident that has $70,000 of passive loss carryforward from previous years.

- Partnership has $50,000 of passive income and makes the entity-level tax election.

- Partnership pays tax on the $50,000 of passive income at the entity level.

- For federal purposes, Partner has $0 federal adjusted gross income and a $20,000 passive loss carryforward ($50,000 - $70,000).

Partner's passive loss carryforward for Wisconsin would be the same as the $20,000 federal passive loss carryforward. For purposes of the passive loss carryforward, the Wisconsin's entity-level tax election does not change Wisconsin's definition of the Internal Revenue Code and does not result in a Wisconsin Schedule

I adjustment. There would be a $50,000 subtraction modification as a result of the entity-level tax election which would result in a $50,000 loss on the Wisconsin return. The $50,000 loss can only be treated as a Wisconsin NOL if there is a federal NOL.